Off-Plan Projects in Dubai Creek Harbour: What to Know Before Buying

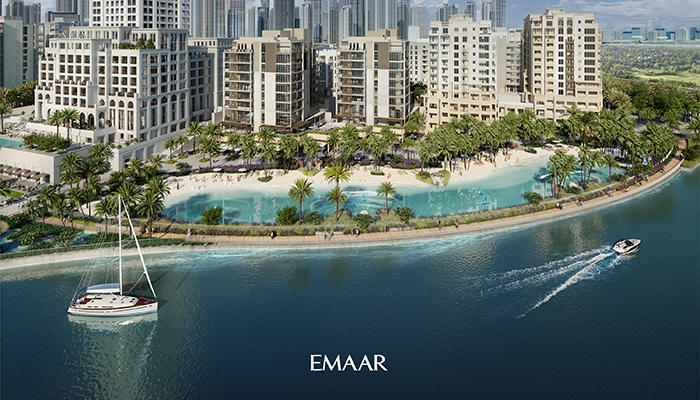

Dubai Creek Harbour has rapidly emerged as one of the most sought-after waterfront communities in the UAE. With its mix of high-rise towers, leisure attractions, and scenic views of Dubai Creek and Downtown’s skyline, it is attracting significant attention from investors looking to capitalize on off-plan projects. Whether you’re a seasoned investor or a first-time buyer, understanding the dynamics of off-plan real estate in this development is essential before committing.

In this guide, we explore everything you need to know before buying an off-plan apartment in Dubai Creek Harbour, from investment benefits and risks to developer credibility and payment plans.

What is an Off-Plan Property?

An off-plan property is a real estate asset purchased before it has been constructed or completed. Buyers typically invest based on architectural plans, brochures, or model units. In Dubai, this type of investment has grown in popularity due to flexible payment structures and high potential for capital appreciation.

Why Dubai Creek Harbour for Off-Plan Investments?

Dubai Creek Harbour offers an unmatched blend of location, future infrastructure, and lifestyle potential. Here’s why it’s gaining traction among off-plan buyers:

1. Prime Location

Located just minutes from Downtown Dubai and Dubai International Airport, Dubai Creek Harbour sits at the heart of the city. With direct metro access, scenic creek views, and upcoming transport links, it appeals to both residents and investors.

2. Emaar’s Visionary Development

Dubai Creek Harbour is a joint venture between Emaar Properties and Dubai Holding, two of the most reputable developers in the region. Emaar’s proven track record with Downtown Dubai and Dubai Marina adds confidence to off-plan investors.

3. High ROI Potential

As the community is still under development, property values are expected to appreciate significantly once key infrastructure and retail zones are completed. Many investors are drawn to the potential for capital gains and rental yield, particularly with the area’s appeal to tourists and professionals.

4. Sustainable and Smart Urban Design

Dubai Creek Harbour promotes sustainability through green spaces, pedestrian-friendly streets, and energy-efficient buildings. It’s designed as a smart city, integrating future-ready technology and eco-conscious planning.

Key Off-Plan Projects in Dubai Creek Harbour

Some of the most anticipated and popular projects currently available include:

- Creek Edge

- Creek Waters

- The Cove

- Harbour Views

- Creek Crescent

Each of these projects offers a mix of one- to four-bedroom apartments, townhouses, and penthouses, many with waterfront views and direct access to retail zones and parks.

Benefits of Buying Off-Plan in Dubai Creek Harbour

1. Lower Entry Price

Compared to ready properties, off-plan homes are often priced lower during the pre-launch or early construction phases, allowing investors to enter the market with less capital.

2. Flexible Payment Plans

Developers typically offer post-handover or interest-free installment plans—making property ownership more manageable over a 3- to 5-year horizon.

3. Potential for Capital Appreciation

Investors who buy during early phases often benefit from value appreciation as the project nears completion and demand increases.

4. Customisation and Modern Finishes

Since the units are under construction, buyers may have limited input on layouts or finishes, and properties are delivered with modern designs and amenities.

Legal Protections for Off-Plan Buyers in Dubai

Dubai has strong regulations to protect off-plan investors:

- All off-plan sales must be registered with the Dubai Land Department (DLD).

- Developers must deposit buyer payments into escrow accounts, ensuring funds are used strictly for construction.

- Developers are required to be RERA-approved, and the project must reach certain milestones before new payment releases.

These regulations significantly reduce the risks associated with incomplete or fraudulent projects.

Tips Before Buying an Off-Plan Apartment in Dubai Creek Harbour

1. Research the Developer

Always choose projects from established developers with a successful track record. Emaar, Sobha, and Dubai Holding are among the most reliable names.

2. Review the Payment Plan

Compare offers and understand all financial commitments—especially post-handover payments or maintenance fees.

3. Inspect the Master Plan

Study how close your unit will be to future amenities like metro stations, schools, parks, or waterfront access. Proximity to these features can impact future value.

4. Understand the Handover Timeline

Make sure you’re comfortable with the completion date, and build in buffer time in case of delays.

5. Work with a Trusted Agent

Choose a RERA-licensed real estate agent who is familiar with Dubai Creek Harbour. They can guide you through comparisons, documentation, and negotiation.

Who Should Invest in Off-Plan Projects at Dubai Creek Harbour?

- First-time buyers seeking modern homes at affordable rates

- Expats looking to own instead of rent

- Investors interested in rental income or capital gains

- UAE residents planning to diversify their property portfolio

Thanks to the master-planned nature of the community, high-quality amenities, and proximity to major areas, Dubai Creek Harbour appeals to a wide range of buyer profiles.

Final Thoughts

Dubai Creek Harbour is more than just another waterfront development—it’s an ambitious urban vision that combines lifestyle, sustainability, and investment potential. Off-plan projects in this district offer a unique opportunity to enter the market early, often at competitive prices, with the backing of reputable developers like Emaar.

However, like all investments, careful due diligence is essential. Know your developer, read the fine print, assess your financial flexibility, and consult professionals to make informed decisions.

With the right approach, buying off-plan in Dubai Creek Harbour could be a smart, future-proof investment—whether you’re planning to live in it, lease it, or flip it when the market peaks.

Leave a Reply