Is Albero a Good Investment in 2025? Breaking Down the Numbers

As one of the first launches in the Green Gate district, Albero at Dubai Creek Harbour captures attention from investors and homeowners alike. Developed by Emaar, this project offers a rare opportunity to buy into a master-planned waterfront community at an early stage. To help you make an informed decision, we’ve broken down detailed pricing, returns, market sentiment, and timeline factors influencing its investment potential in 2025.

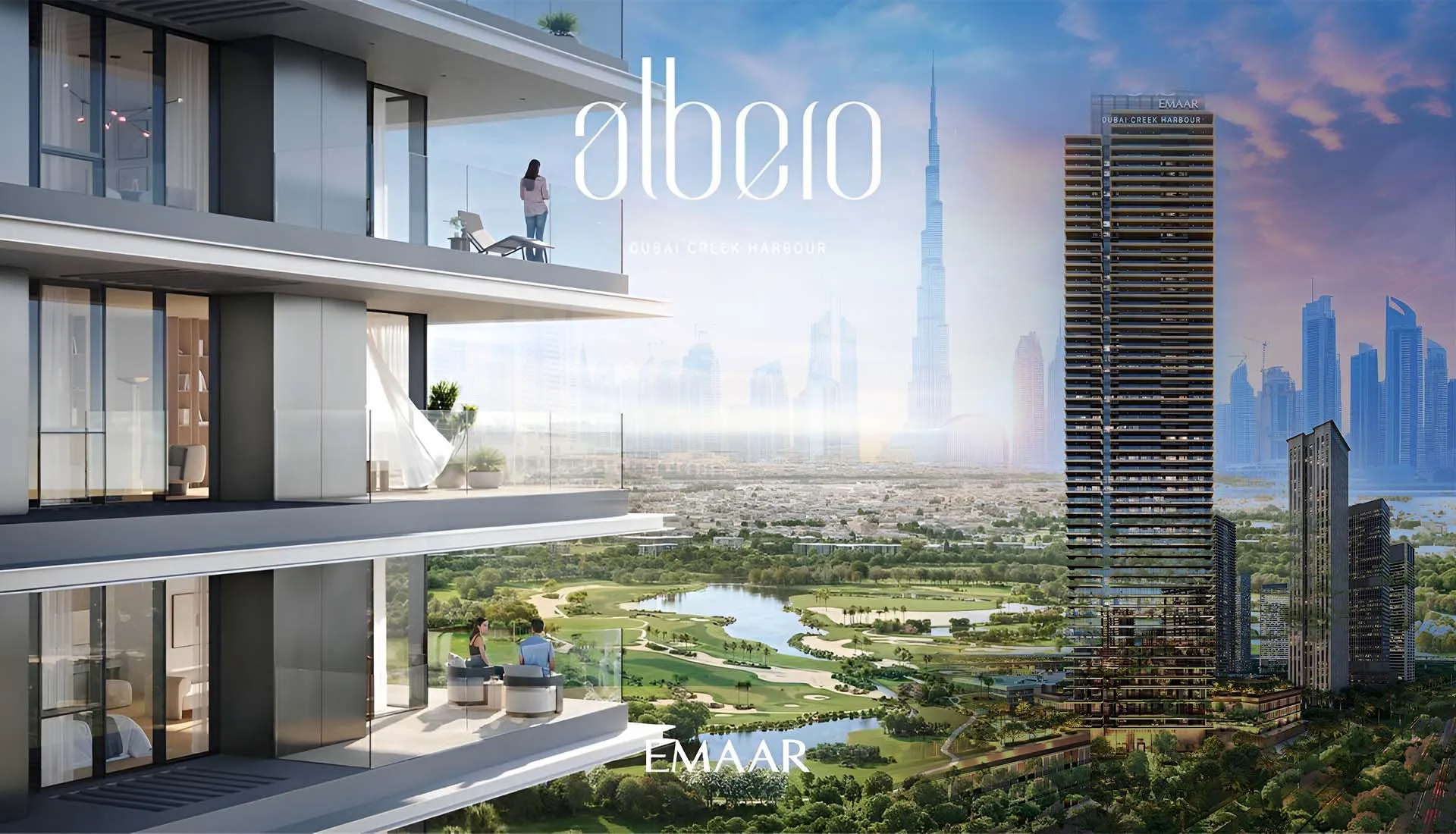

1. Overview: What Is Albero?

- Location & Developer: 479 residences (1–3 bedroom apartments and 3‑bed townhouses) in Emaar’s Green Gate district—a sub-community within Dubai Creek Harbour, designed to balance luxury and nature

- Unit Sizes & Prices:

- 1BR: from AED 1.82 M (≈750 sq ft)

- 2BR: from AED 2.75 M (≈1,117 sq ft)

- 3BR: from AED 4.2 M (≈1,742 sq ft)

- Payment Plan: 80/20 with just 10% down; long-term construction instalments through 2029

- Completion: Around Q4 2029

2. Cost Breakdown & Payment Flexibility

- Booking: From 10% down (AED 182,000–420,000+ depending on size).

- Milestone Payments: Staggered through construction until final handover

- Investor Advantage: Low upfront cost helps maximize leverage—promising ROI even on deposit alone .

3. Rental Yield & ROI Projections

A. Current Market Data

- Average ROI for 1BR in Dubai Creek Harbour: 5.75% (rents ~AED 115K/year)

- Prime units near the waterfront may yield up to 8% ROI

B. Why Yield Is Competitive

- Waterfront living and upcoming metro/amenities make the area rental-attractive.

- Early launches like Albero benefit from both “first-mover pricing” and later capital appreciation.

C. Community Appeal

- A Reddit investor noted:

“People who live there absolutely love it … prices are expected to jump at least 10–15%.”

4. Capital Appreciation Prospects

- Early-Buyer Advantage: As Green Gate matures, new launches will likely be priced higher, increasing Albero’s relative value

- Skyline Evolution: Completion of Creek Tower and metro connections in 2026–2027 could significantly boost area desirability

- Supply Dynamics: With just five towers in the district, scarcity supports price stability .

5. Location & Connectivity Boosters

- Transport: 10 mins to Downtown/Burj Khalifa, 15 mins to DXB, 40 mins to DWC. Metro connectivity soon available

- Amenities: Proximity to Creek Beach, Marina, Central Park, museums, leisure, and schools

- Neighbourhood Quality: Emaar’s reputation ensures high-standard infrastructure—water taxi services, retail district, and waterfront promenades enhance livability.

6. Real Buyers’ Perspectives

From:

- For end-users:

- “If your main goal is to live there, Creek Harbour is one of the best areas. People who live there absolutely love it.”

- For investors:

- “There will only be five buildings in Green Gate … prices are expected to jump at least 10–15%.”

- Cautionary note: Some investors warn against late-stage flips or overpaying

7. Who Should Consider Buying Albero?

A. For Investors:

- Goal: Long-term capital gains (hold until handover or beyond).

- Strategy: Buy early, minimal down payment, hold through 2029, and benefit from rising demand.

- B. For End-Users:

- Seeking a modern home rich in amenities and connectivity.

- Ideal for families, professionals, or empty-nesters who value lifestyle and space.

C. For Starter Families:

- 2BR units priced ~AED 2.75 M, with future Blue Line metro access and community green spaces, make Albero a compelling community home.

8. Risk Considerations

- Construction Delays: Timelines might shift, impacting rental start and appreciation timing.

- Market Exposure: Several towers under construction might temporarily dilute rental demand.

- Holding Period: ROI projections rely on mid-long term holding; flipping pre-handover is less certain

- Pricing Premium: Pre-2022 Creek Harbour deals may look more attractive in hindsight—but current valuations reflect future infrastructure gains .

9. Calculation Example: Early Investment Return

- Booking: AED 182,000 down on a 1BR unit (AED 1.82 M).

- Expected rental: AED 115,000/year → yield: ~6.3%.

- Completion of metro and adding amenities → could push capital appreciation another 10%-15% between 2025–2027.

10. Summary: Good Investment, with Strategy

| Aspect | Assessment |

|---|---|

| Rental Yield | 5.75%–8% (strong) |

| Capital Appreciation | 10–15% upside expected |

| Developer Trust | High (Emaar) |

| Infrastructure Timeline | Metro & tower make 2026–2027 pivotal |

| Risks | Construction, holding period, oversupply |

Conclusion: For investors and homeowners seeking a strategic early entry into a rising waterfront district with sound rental returns and future upside, Albero represents a compelling investment in 2025—when approached with patience and planning.

Leave a Reply